writer, editor, bar owner, interviewer, former aspiring cowboy

Thanks for stopping by, friends! I live with my wife and two kids in Beacon, New York. We moved here in 2021 from Oakland, California, where we still co-own a place called North Light, a hybrid of a bar, café, bookstore, and record shop. I wrote an article for The California Sunday Magazine about what it takes to keep a small business alive during a pandemic.

I work with a group of wonderful people at Substack. My role is Head of Culture and Music, helping to bring great writers and artists to the platform and get them established.

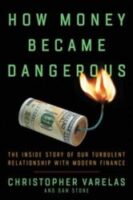

I co-wrote How Money Became Dangerous (Ecco, 2019) with Chris Varelas. The book tells a handful of entertaining true stories from the financial services industry—spanning from the mid ’80s up to the present day—exploring key moments that changed Wall Street and the world of money from simple and functional to complicated and contentious.

Occasionally I’m lucky enough to interview my heroes for City Arts & Lectures, among them Patti Smith, George Saunders, Elvis Costello, Bruce Springsteen, and Pico Iyer.

Radio Silence is a Pushcart Prize–winning magazine of literature and rock & roll that I founded and for which I served as editor in chief. Our contributors included Bruce Springsteen, Carrie Brownstein, Lucinda Williams, Stephin Merritt, Greil Marcus, Sam Lipsyte, Robert Pinsky, Rick Moody, David Remnick, Thao Nguyen, Paul Muldoon, Kim Addonizio, Daniel Handler, and many others. Either we’re on a long hiatus or we’ve folded up. Not entirely sure.

I worked for many years at the National Endowment for the Arts as a program manager for the agency’s national initiatives. My main gig there was to write and produce radio documentaries about classic novels, jazz, and Shakespeare. A couple favorite programs I worked on, which have survived the turbulent political tides of Washington, are The Big Read—a nationwide reading initiative for which I produced 20+ documentaries—and Poetry Out Loud—a recitation contest now in its 16th year; several million high school students have participated.

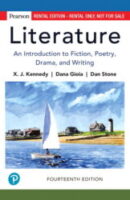

I also edit a college textbook titled Literature: An Introduction to Fiction, Poetry, Drama, and Writing, with Dana Gioia and X. J. Kennedy (published by Pearson).

On a personal note, I’m particularly fond of pickles, baseball, and bicycling.

And of my wife, Kim Gooden, who’s a brilliant writer, editor, and fine human. The kids are all right, too.